After you have downloaded and opened the application package from grants.gov, you'll get a form that looks like this. You do need to make sure that you check the opportunity title, make sure that it's the competition that you're applying for. But the rest of it will be filled out by grants.gov, which is a huge improvement over the former paper copies. After that, you'll begin filling out the forms. As you can see, this one has several forms that need to be filled out. You do want to fill them out in order because the answers that you give for these top forms will be used to populate the bottom forms. If it is highlighted with a red outline, that means that particular form or that particular portion does need to be filled out. Now, it's simple to fill out the forms. You take them from the left-hand column, you highlight them, and you click them so that it goes over to the right-hand column. You will not be able to open it unless it's in the right-hand column. You simply highlight it, click open form, and it takes you right down to the portion that you need to complete. Again, if it's highlighted in yellow and has the red outline, it is a portion that you need to complete. You don't need to complete these other portions unless there's something that you need to put in there. Again, you want to fill out these forms or these areas first so that it will continue to populate the other areas. And then once you're done, you simply click the close form part at the top of the page, and it takes you right up to the beginning. Again, if you'll notice, this save and submit part is grayed out. When you...

Award-winning PDF software

3067 Form: What You Should Know

Note: FEMA does NOT have jurisdiction over the areas declared during a disaster (i.e. the Federal Government). However, FEMA's jurisdiction for the disasters is still intact. If FEMA's assistance is needed for a tax year, you must submit the tax returns for the year you are attempting to claim assistance for. Taxpayers who do not file their federal and State income tax returns by April 15, 2018, risk the following penalties: 3. FAMILY RESPONSIBILITY INSURANCE — FAMILY RESPONSIBILITY INSURED AND INDIVIDUALS LIVING IN THE TEMPORARY ASSISTANCE Area In an area declared by FEMA to be a disaster area, the following requirements apply: Your household is a member of a household that has received at least 2 of the following types of benefits at least once during the 30 days immediately preceding the date of the disaster: Emergency assistance (Food Stamps) Uninsured premium and/or excess coverage (Health Insurance) Temporary housing (including rental housing) Family allowance. Income and payroll credits, such as medical expenses, child care, or housing costs for you and your family members while they look for a new home. 4. WELFARE ASSISTANCE (WIC) — WELFARE ASSISTANCE (WIC) ELIGIBLE HOUSEHOLD — CALR — BINGHAMTON UNIVERSITY For each household member who is considered eligible for assistance under this subpart, the following requirements shall apply: The household has had a child in the household during the 5 preceding years and the child was adopted in the 6 current year. The household does not use public or private school as its primary educational destination. The household meets at least one of the following conditions (see 6 C.F.R. § 36.104): Income (as defined in section 226(f)(5) of the Social Security Act): For a one-parent household, this is 1.5 times the household income for all the husband's and wife's earnings for the current year, or 2 times the household income for all the husband's and wife's earnings for the prior year, whichever is less. Cost-of-living adjustment (C.L.A.

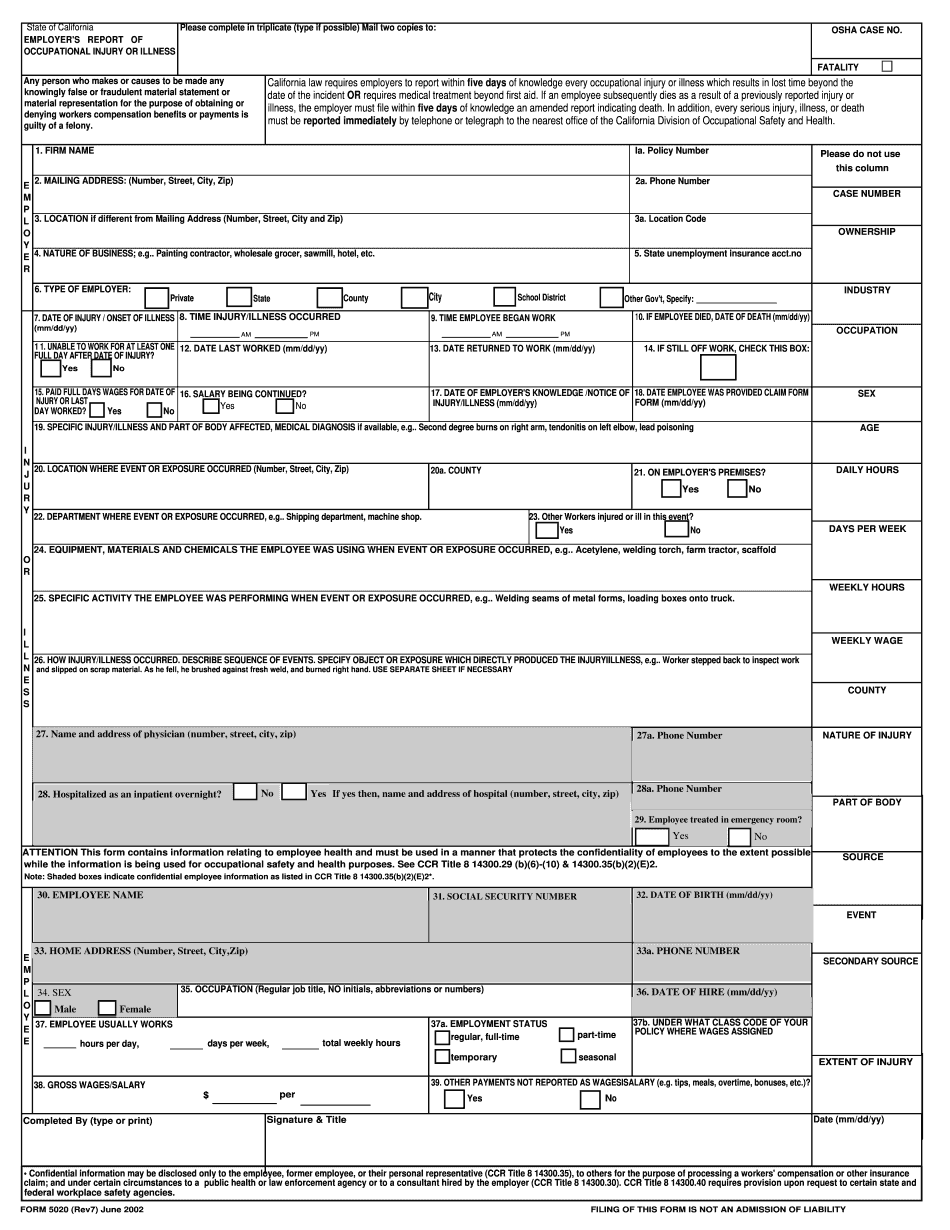

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5020, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5020 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5020 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5020 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 3067