Award-winning PDF software

Statefundonline Form: What You Should Know

LOG IN. The State Fund offers benefits to customers through the following categories: All members • All retirees • All survivors • Active members • Registered voters. Members are eligible to participate and receive the following benefits for life based on their age: • Age 65 or older: Pension, Health and Long Term Care insurance • Age 62 or younger: Disability Insurance. The State Fund offers members the following insurance for their lifetime: • Health Insurance • Disability Insurance • Survivor Benefit Insurance (Spouse's benefits after divorce or death) The State Fund offers benefits to the following: • Caregivers (dependent children) • Spouses or common-law partners • Ex-Military members • Children (age 19 months or older) To be eligible to receive these benefits, you must have already purchased your policy as a State Fund customer. State Fund Products • State Fund Safety and Seminars · State Fund Financial & Administration Services • State Fund Health Insurance · State Fund Long Term Care Insurance · State Fund Financial and Administrative Services The State Fund provides insurance on life, accidental death & dismemberment, hospitalization, disability and dependent care for all of its members. To be eligible to purchase life insurance, you must be age 18 or older and a State Fund customer at the time you enroll for the first policy, or at age 22 or older when you renew your policy after its 1-year anniversary. Age 62 or younger applies to purchasing the Life Insurance policy if you are an active member at that time, or for the policy's 1-year anniversary. • State Fund Disability Insurance. The State Fund offers benefits to all of its residents, regardless of age, and to a limited number of our retirees. The State Fund provides benefits in two categories. Active members can elect to receive disability benefits beginning July 13, 2020, and the disabled may elect benefits as early as age 19. Other members who are not active can have their disability claim processed starting at age 52. Disabled members can receive any benefits available to any active member of the State Fund. • State Fund Long Term Care Insurance is an extension of the insurance policy purchased by retirees or survivors of members who need ongoing nursing care for mental, emotional, or physical conditions. Current members can keep their current policy and maintain their benefits for all or certain benefits.

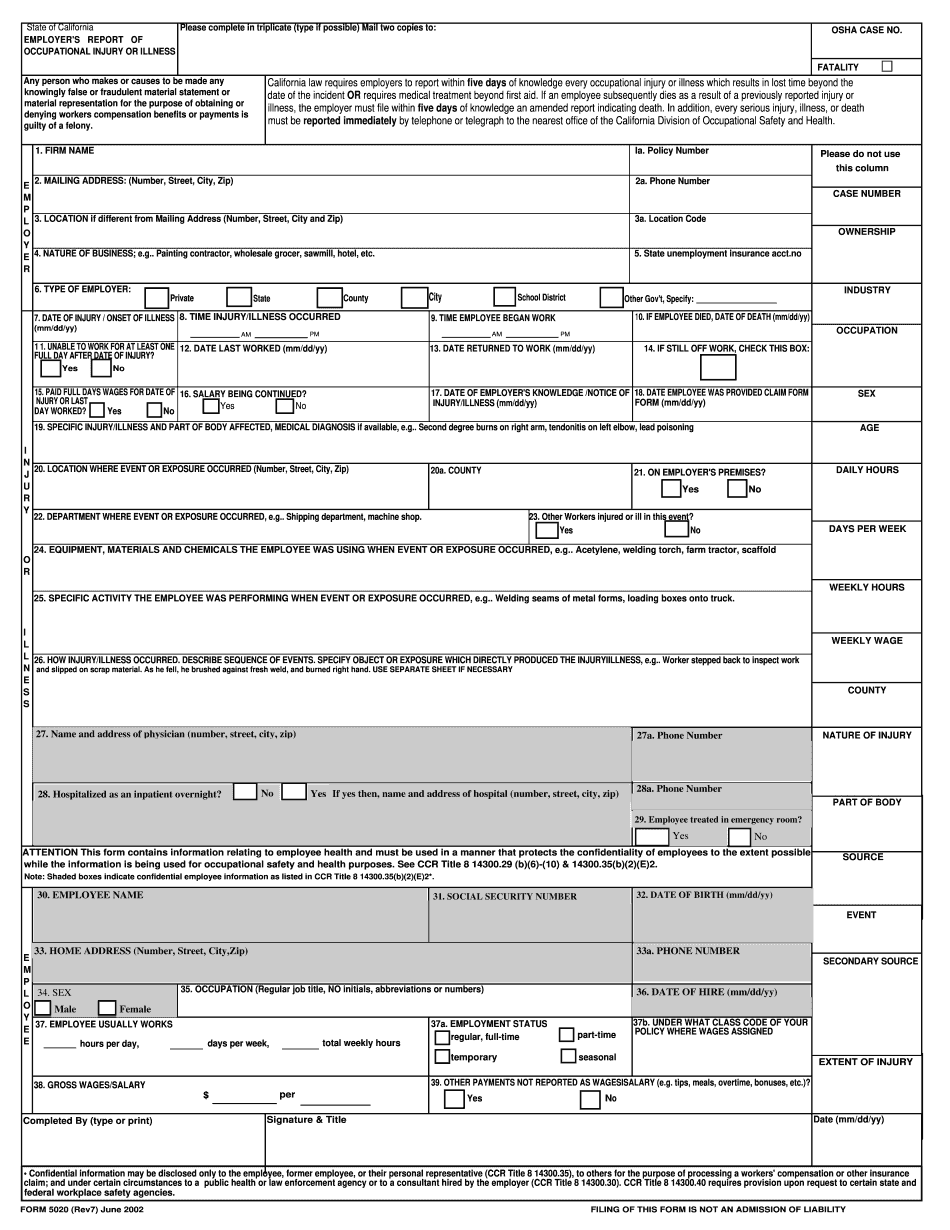

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5020, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5020 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5020 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5020 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.