Music, everyone hates the word audit, but it's a common part of the workers' compensation policy process. Part 5, Letter G, of your work comp policy gives your insurance carrier the authority to conduct their premium audit. The audit is usually done 30 days after your policy expiration date. A workers' comp premium audit determines what should have been the true cost of your policy. The audit findings will show if more premium is owed to you or if a credit is owed to you. To minimize the disruption of any premium audit, use these best practices: 1. Maintain organized payroll records. Be prepared to provide the premium auditor with the following: payroll registers, highlighting any overtime pay; the four most recent quarterly tax reports; federal 941 and state payroll tax returns; 1099 forms for all independent contractors; insurance certificates for hired subcontractors, if any; and a list of all current owners. 2. Know your employee classification. Did you know that work comp premiums are calculated based on employee job class codes? If you misclassify an employee, for instance, your secretary who works in your warehouse, you will get hit with an additional premium bill at audit time. Therefore, write down your employees' job descriptions and make sure those descriptions match up with your policy's class code. 3. Respect the premium auditor. Give him or her a quiet, well-lit place to work and provide all your well-organized records. 4. Request your audit work papers from the auditor. Audit work papers are a roadmap that explains what your company does and how the auditor arrived at the payroll numbers, along with the classifications that determine the final audited premium for the policy. If you have any questions regarding audits or need a new work comp policy, please call 1-800-894-6787 to talk with a licensed insurance broker...

Award-winning PDF software

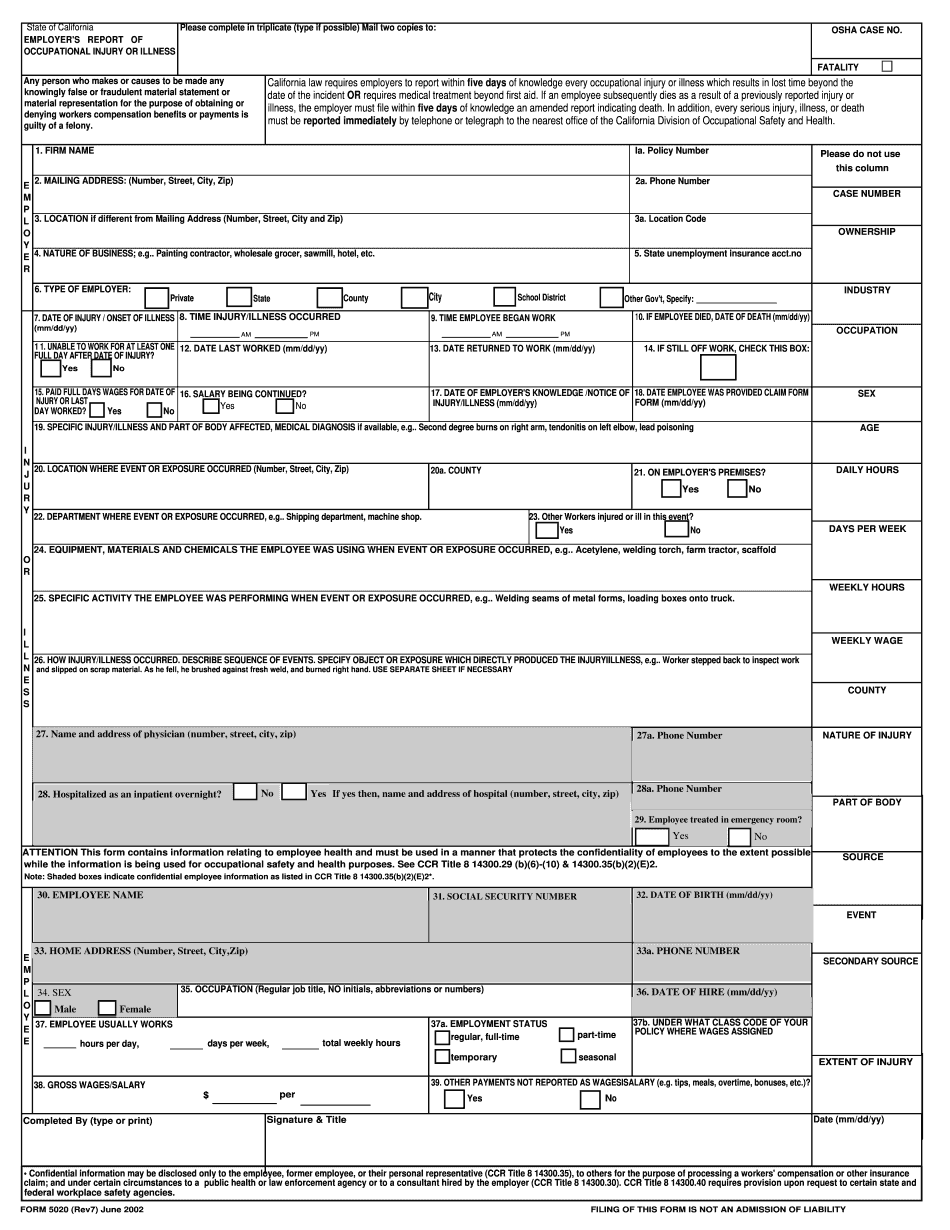

E3301 Form: What You Should Know

NSW Workers' Compensation Claims — The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The State Fund News & Information The States have released additional information in regard to the claims process for 2016/17. Workers' compensation claim process update — The State Fund News & Information The NSW Secretary of the Department of Enterprise and Innovation has released information on the new Claims Processing Procedures in NSW as well as the new Claims Processing Fee for 2016/17. The New Claims Processing Procedures N.S. Department of Enterprise and Innovation. (2018). NSW Workers' Compensation Claims — The State Fund News and Information. Retrieved on 25 Oct, 2018. N.S. Department of Enterprise and Innovation. The New State Workers' Compensation (SCI) Claims for 2016/17. Retrieved on 25 Oct, 2018.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5020, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5020 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5020 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5020 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing E3301 form