Award-winning PDF software

Form5020.pdf - california department of industrial relations

Name and address of attorney (address, city, zip, and state, if state required). 29. Physician's phone number. 30. Physician's fax number. 31. Number of pages of medical opinion for you to sign. 32. Form of agreement to be signed (either the original agreement or the current version), if any. (Note: you may be required to sign an agreement that gives the lawyer and the other person (your spouse) some degree of confidentiality.) 33. The agreement to sign in its entirety. 34. Any other information you think is important. 35. Please return this form to: John D. Krieger, and Associates,, 515 1st Ave., Suite 800, Sacramento, CA 95 OR Mail to: John D. Krieger, and Associates,, 515 1st Ave., Suite 803, Sacramento, CA 95. I hereby sign as follows: John D. Krieger, and Associates, Dated: June 30, 2002, By: (Signature of Physician) Name: Physician (required but not required) Date of.

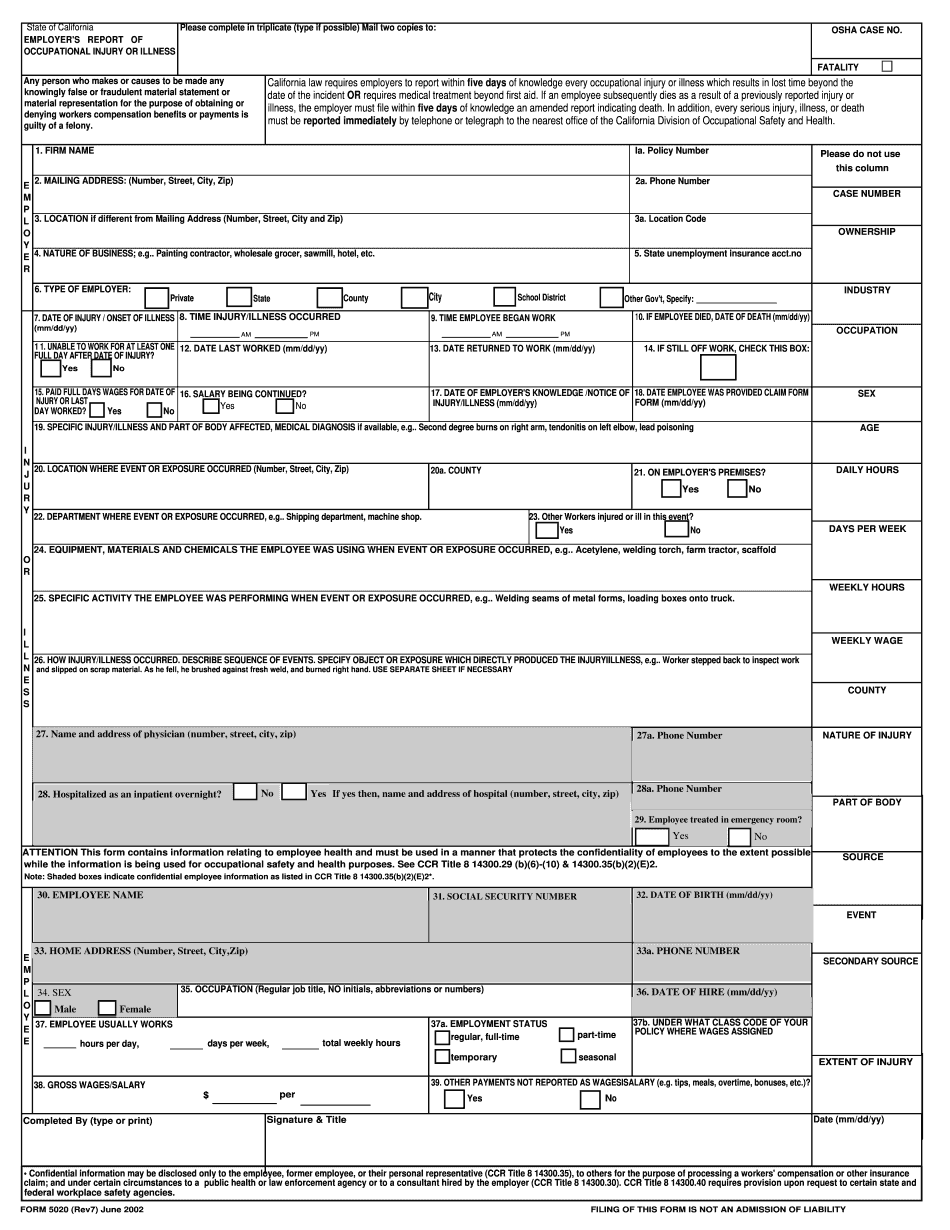

Employers/employees - california workers' compensation

Illness. This form may be filed by your manager, supervisor, or human resources person. The form may also be submitted electronically through the Internet using the Employer's Information System (EIS). The form must be filed with the Human Resources Office by the close of business on the day after the injury/illness is discovered. The Employer must then file a copy of the form with the Insurance Commissioner within ten days with a letter stating what action would be taken if additional injury or illness were discovered. If the Employer does not file a complete . Report of Occupational Injury or Illness, and the Injury or Illness is not covered by your Health Insurance Plan (HI plan), the Health Insurance Company may pursue the Employer's claim against you. In addition, when an injury/illness is found during an accident, the Insurance Commissioner may issue a civil notice to the Employer, stating that.

Form 5020 - fill online, printable, fillable, blank | pdffiller

Try Now! Try Now! Try Now! ✓ Fill out or print PDF forms anywhere ✓ Choose from many formats to help you fill out any financial form ✓ Add a picture ✓ Add an email ✓ Add text and add links ✓ Create and attach documents to forms ✓ Try Now! Try Now! Try Now! ✓ Submit form ✓ Try Now! Try Now! Try Now! ✓ Form completion ✓ Enter financial information as you normally would ✓ Choose from over one million entries ✓ Fast and easy to use ✓ No registration process required ✓ Upload documents online ✓ Read more in terms of this tool's function. Enter your account information for your checking account for example CASH AGGREGATE 6, Add Money Here CASH RATE 1 – 2 (depending on your check) Add to Check — 6, — 6, CASH RATE CASH RATE CASH RATE CASH RATE CASH RATE CASH RATE CASH RATE.

Instructions for filling out the following forms:

This form may also be accessed via the DWC website. (Click here for an overview of the DWC.) The DWC claims may result in medical care, treatment, disability compensation, job loss, or other benefits in the form of payments or benefits. DWC and DWC claims can be filed by an injured worker against a person or the business they work for. Employers are responsible for investigating claims before making them. They can file a grievance if a DWC claim was not timely submitted. The Employer's Report of Occupational Injury or Illness (Form 5020), included here, and the Workers' Compensation. Claim Form (DWC 1) to the Department of Labor. The DWC claims may result in medical care, treatment, disability compensation, job loss, or other benefits in the form of payments or benefits. DWC and DWC claims can be filed by an injured worker against a person or the business they work for. Employers.

Adminsure

A) Unless otherwise provided herein or on any form to which this form applies, gross wages for the employer of any full-time or part-time employee shall be computed and the amount thereof shall be stated. For purposes of the above computation: (i) All income, fees, royalties, tips, and all other compensation or reward received by such employee during the period beginning with the date such employee was hired and ending 31 days prior to termination of such employee's employment by the employer shall be excluded except where the following conditions are met: (A) Where a tip credit is allowed for the employer, or (B) Where a credit is allowed under section 6 of the Fair Labor Standards Act of 1938 (29 215), subject to prior approval of the Director. (ii) All commissions received by such employee shall be excluded. (iii) All compensation or credit which is contingent upon actual.