Award-winning PDF software

Form 5020 Lansing Michigan: What You Should Know

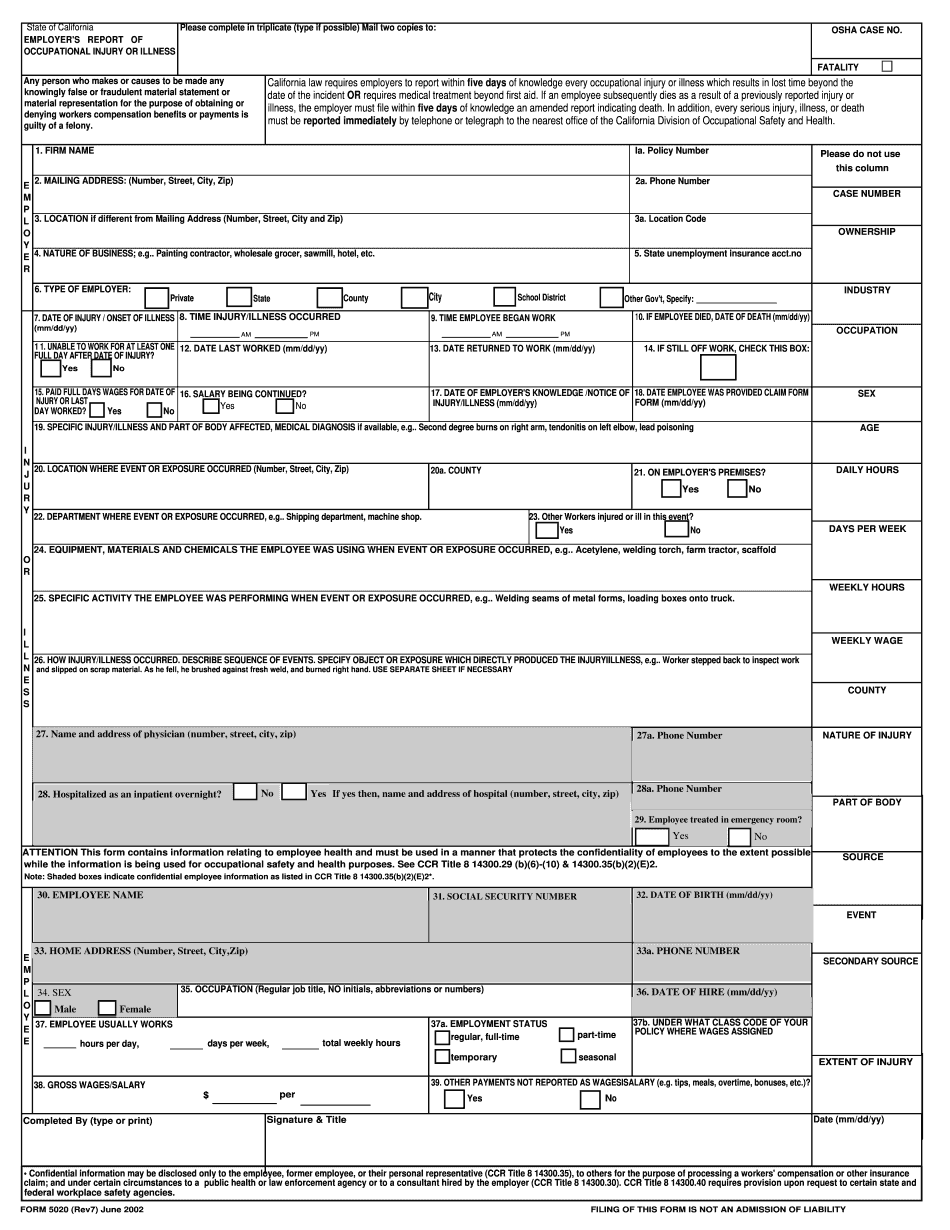

Application to the Department. NOTE: In the event of an accident on a portion of the property used for the above described purposes or as a road, the employer may be liable for compensation damages based upon the Michigan Agricultural Land Claim Act; M.A.L.A.C.L. § 517.101(9). Form 5020 and State Department of Agriculture and Rural Development's Form 4051 may be used to document the use of Agricultural Use by an employee. You can apply for the land use tax by submitting Form 5020 and a completed Form 4051, and payment of the tax to the State Department. Payment can be made by paying the tax by mail. (Check or money order. Address to postpaid USA bank account; not the same.) Michigan Tax Payments form (Click link for download) Form 5020 and State Department of Agriculture and Rural Development's, Form 4051 may be used to document the use of Industrial Use. You must file Form 5020 and the required fee's with the Department by the due date, and complete an employment eligibility questionnaire if applicable. Please mail to and fax the required forms to. Your completed employment eligibility questionnaire will be reviewed by the Department and the forms and fees will be mailed to you. . In order to use State Department of Agriculture and Rural Development's “Pursuits of Agricultural Use” method, an employee must be employed during the season when the property is used for agricultural purposes and must obtain Michigan Department of Agriculture and Rural Development's (ARM) approval for the application. Approval will be granted if the property is: An active agricultural property that is used for the sale or production of agricultural commodities as defined by the Michigan ARM regulations; A parcel in which a tenant farmer or a tenant farmer on behalf of a tenant farmer is conducting operations as a separate business from the landowner; or A property located on a road that is used for the transportation, sale or storage of agricultural products. If the use is approved as defined in the ARM regulations, the Department will consider the applicant's property owner's authorization as well as the employee's own authorization to use the property for agricultural or industrial purposes. In order to be qualified, the following must be true: The use of the property for agricultural products can be considered incidental to business operations as determined by the Department; and The employee's permission and authorization is not contingent or conditioned upon obtaining a permit from the Department.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5020 Lansing Michigan, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5020 Lansing Michigan?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5020 Lansing Michigan aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5020 Lansing Michigan from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.