Award-winning PDF software

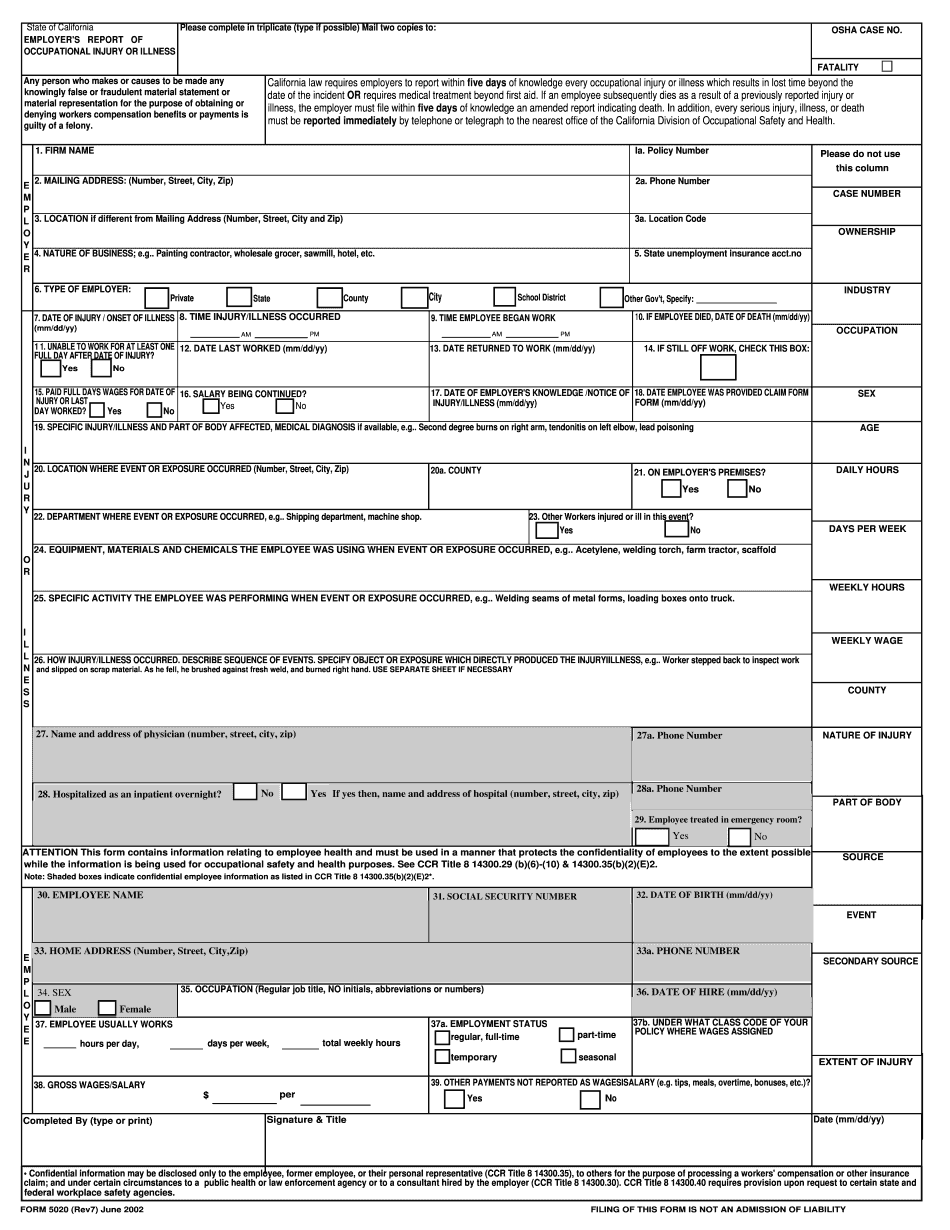

Form 5020 Sandy Springs Georgia: What You Should Know

Body Shop Near Me. This one is a little different but, in essence the IRS requires your business to have a registration with them if your business sells the same thing on three different days. Here is a brief description... There are a number of states where the sales tax law requires you to collect sales tax on the sales of the goods. (A sales tax is generally calculated using a separate tax rate applicable to each business transaction, with the lowest rate applicable to the sale of goods used in conducting business). Many of these states offer a simplified tax registration for an additional charge that is separate from the sales tax. In some states, your local tax administrator will require that your business register for a sales tax. The basic rule to collect sales tax by the state you're in is: For sales to the Federal Government, the Sales Tax Rate in that state is considered to be the same as a Sales Tax Rate applicable to the sale or exchange of goods by the Federal Government to your local district. For sales to other states, the Sales Tax Rate in that state is considered to be the same as a Sales Tax Rate applicable to the sale or exchange of goods by the states the goods are bought or traded in to. These sales tax rates are usually referred to as a “District Share of State Sales Tax.” Because all types of goods require some type of sale, it follows that a business can't legally collect sales tax in just one state. For example, the rate may be the same for a purchase of two items from the same vendor in one locality, but different for a purchase of just one item from the same vendor in some other locale. For example: The seller of two boxes of TO pasta, each containing three cups of TO sauce, might have to collect state sales tax on the sale, even though the items do not contain one another. As to why it matters whether you collect a state's sales tax or a local tax. The reason is fairly simple: If you collect the state sales tax, then you generally do not have to register for the local portion of the tax, so you can operate as an unregistered seller (e.g., a “tobacco store”). If you're wondering if you need a Federal sales tax return if you're selling interstate, well...yes. A Federal sales tax return is needed on purchases from dealers in interstate commerce and to tax certain transactions (such as the sale of inventory).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5020 Sandy Springs Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5020 Sandy Springs Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5020 Sandy Springs Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5020 Sandy Springs Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.