Award-winning PDF software

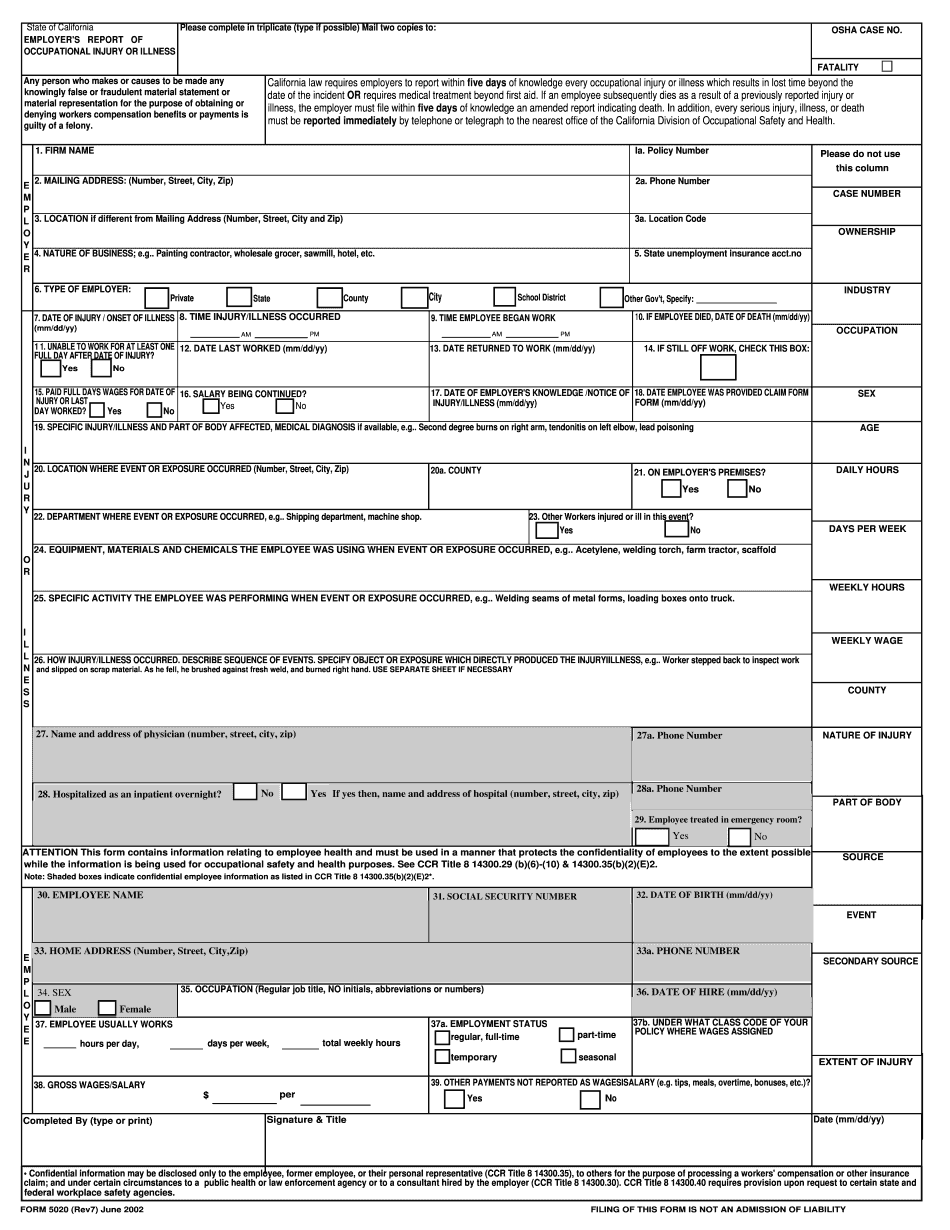

Fort Worth Texas online Form 5020: What You Should Know

Northeast Community Action Agency, Inc., Northeast Community Action Agency, Inc. (NCAA) is a Non-Profit Corporation, organized under Chapter 501(c)(3) of the Internal Revenue Code. Northeast Community Action, Inc. (“NCAA”) was incorporated under the laws of the State of North Carolina on September 1, 2014. In order to be classified as a Nonprofit Corporation, all activities of the “Non-Profit” must be conducted exclusively in a non-profit manner. NCAA will operate pursuant to all state and federal laws, regulations, rules and regulations. No action which materially affects its non-profit status can be taken without a written approval from the IRS. The IRS will not approve a “Non-Profit” corporation if it is located in a State with more than 50,000 residents unless the corporation has a physical presence in that State and its principal purpose of conducting its operations in that State is in that State. This “physical presence” must be in more than 70 miles from the corporation's executive offices at its principal place of business and must be maintained in the same manner as a main business location. The corporation will be responsible for paying the regular quarterly state business taxes, a reasonable rate of compensation, and all franchise fees as required by law. Fees for state services other than franchise fees are to be collected by the State (as required for other business entities), while the fees for services covered under franchise fees (Franchise Taxes and Business Excise Taxes) must be paid by the organization within the year. The Corporation must include with its Form 1040, U.S. Return of Ownership and Certification for Corporations, the appropriate tax form, complete with form 1098-N Form for Forms 1040(X) and 1040EZ, and the IRS Form 4868 and Form 5611, and other applicable identification numbers. Northeast Community Action, Inc. shall obtain approval from the Internal Revenue Service to pay a reasonable rate of compensation for each officer, director, employee and agent, as appropriate. If the corporation receive more than 1,000,000 from the franchise fee, the corporation will register with the North Carolina Bureau of Corporations and be required to pay the required Franchise Tax by the date of payment as a condition for the initial investment of franchises.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Fort Worth Texas online Form 5020, keep away from glitches and furnish it inside a timely method:

How to complete a Fort Worth Texas online Form 5020?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Fort Worth Texas online Form 5020 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Fort Worth Texas online Form 5020 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.