Award-winning PDF software

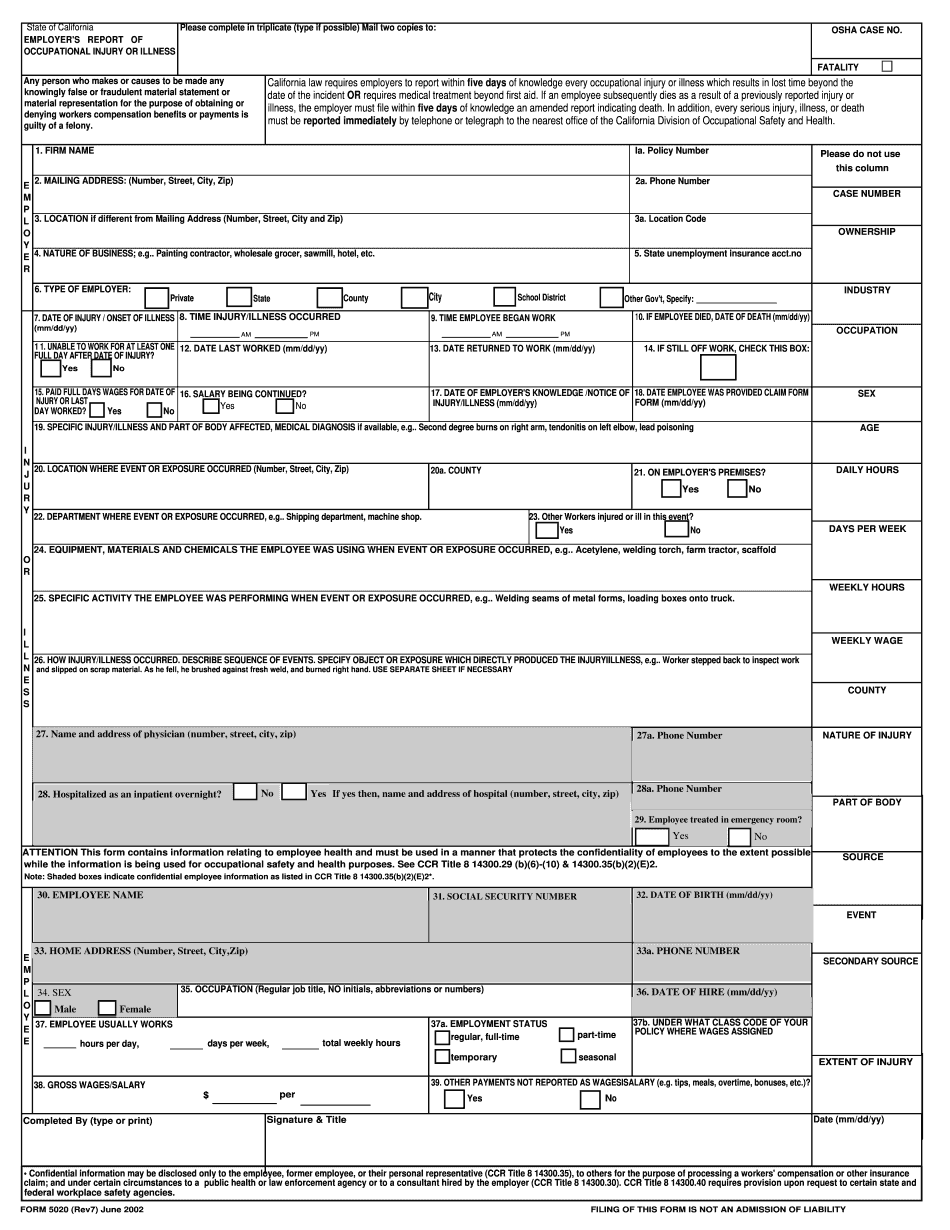

Form 5020 for Franklin Ohio: What You Should Know

Complete this form if you're not able to pay a full restitution for a civil case in person; otherwise, you can pay in full by mail or by using this secure online payment system. For the entire body of the county or the State of Franklin, Ohio: Form 2504 for Franklin, Ohio. Form 2504.pdf This form is only for Franklin County Ohio. Fiscal Year 2014, Fiscal Year 2013, or Fiscal Year 2025 or earlier. For other cases, you must contact a court clerk for instructions or use the Form 2504. Franklin County, Ohio — Reparations Recovery Program (Form 200), and Form 200.pdf Franklin County, Ohio Reparations Recovery Program — This form contains information about the Reparations Recovery Program and contains all the information about the Reparations Program that is required in case you received money through the Reparations Recovery Program. This form should not be used if you need to pay for your own filing fees or costs as these are not covered by the program. If you have questions on the Reparations Recovery Program forms, you are advised to consult your county clerk or your own attorney. Fiscal Year 2014, Fiscal Year 2013, or Fiscal Year 2025 or earlier. If other cases, write to your county clerk and ask for instructions or use the forms. The “Franklin County, Ohio” in this form is meant for Franklin County, Ohio only. Franklin County, Ohio Reparations Recovery Program (Form 300) and Form 300.pdf The Reparations Recovery Program in Franklin County has a payment option through the Franklin County Treasurer's Office that allows you to pay for your filing fees and costs, or you can pay for your filing fees, expenses, and attorneys fee. The payment can be made at any branch or office of Franklin County Treasurer's Office on a weekly, bi-weekly or monthly basis. Your payment is automatically calculated each week beginning Friday the 13th through the next Monday of the following month. Form 300 and Form 300.pdf are designed for Franklin County only. FRANKLIN COUNTY, OHIO: Taxpayers should not send tax returns for county property taxes unless they want to pay the property tax based on a single appraisal. Taxpayers that do a multi-assessment will be assessed on a percentage of the property's appraised value and will be responsible for paying the property taxes based on each value. You do not have to pay taxes for every property on your tax records.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5020 for Franklin Ohio, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5020 for Franklin Ohio?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5020 for Franklin Ohio aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5020 for Franklin Ohio from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.